Retro Pay by Element in Oracle HRMS Payroll

Retro Pay Setup in Oracle Payroll

What is retro pay??

Retro pay is usually run for back dated increments or promotions to be paid in the current period. For instance, in a company, Increment arrears are paid two months after the increment period, so we need to run retro pay to make this payment in current period.

How do we do it??

1) Create an Event Group. See How to create Event Group

2) Attach it to the Element --> Recalculation Tab

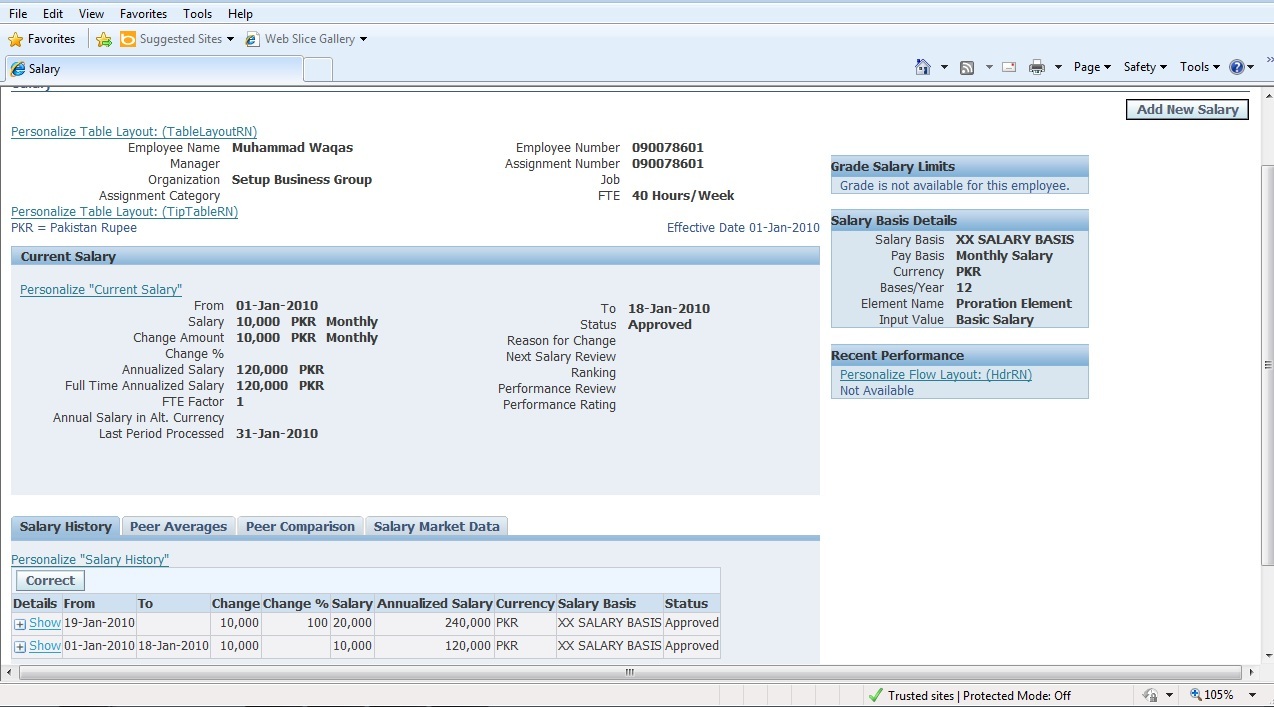

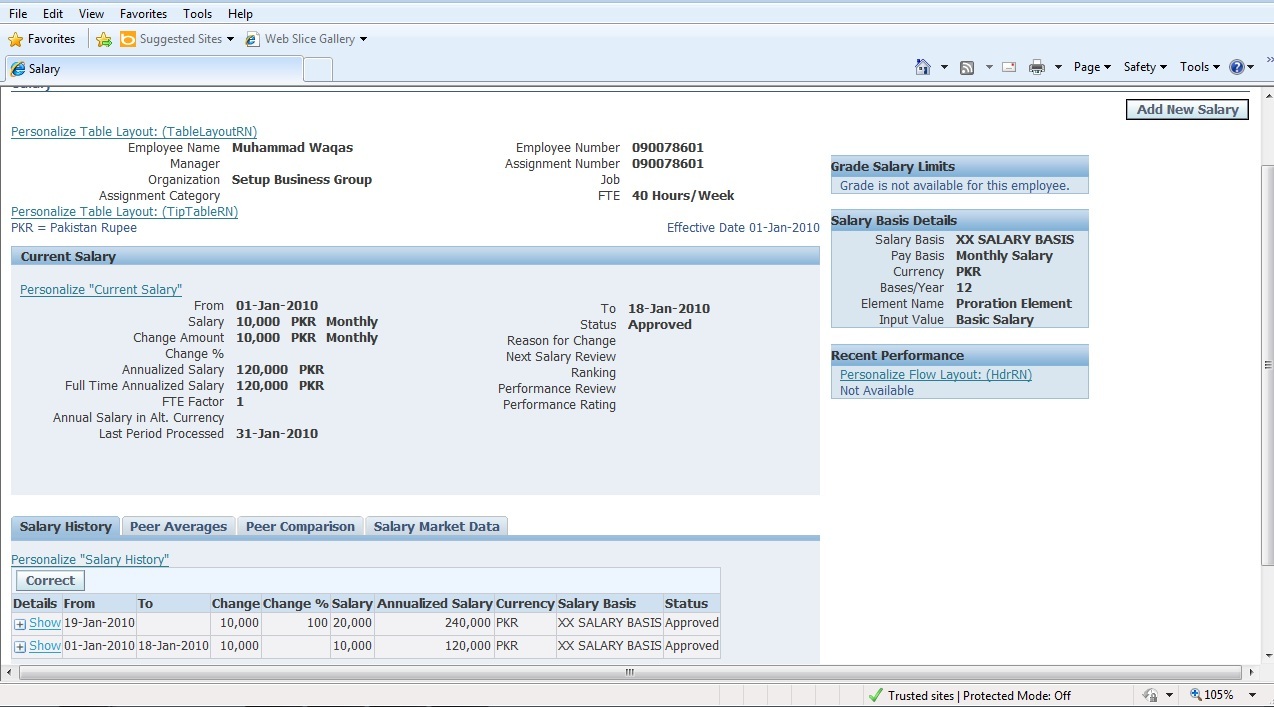

3) Make a back dated salary Increment

Consider we are currently running the payroll for period Mar-10 and we made a salary increment in the period Jan-10 and payroll for Jan-10 and Feb-10 is already run.

4) Create assignment set

Create assignment set to include your desired list of employees for which you want to pay increment.

See How to create Assignment Sets

5) Create Element Set

You may include the elements for which increment are paid. Differential amount (Arrears) will be shown separately for each element, as represented by process name "Retro pay by element"

6) Run Concurrent Program "Retro Pay by Element"

7) View Element Entries

Global HRMS Manager --> People --> Enter & Maintain --> Assignment --> Entries

As you can see there are 3 entries for Proration Element (Proration formula used) for JAN-10

Proration formula is run for the period JAN-10, See How to use Proration formula

Differentials:

JAN-10 4,193

FEB-10 10,000

MAR-10 10,000

What is retro pay??

Retro pay is usually run for back dated increments or promotions to be paid in the current period. For instance, in a company, Increment arrears are paid two months after the increment period, so we need to run retro pay to make this payment in current period.

How do we do it??

1) Create an Event Group. See How to create Event Group

3) Make a back dated salary Increment

Consider we are currently running the payroll for period Mar-10 and we made a salary increment in the period Jan-10 and payroll for Jan-10 and Feb-10 is already run.

4) Create assignment set

Create assignment set to include your desired list of employees for which you want to pay increment.

See How to create Assignment Sets

5) Create Element Set

You may include the elements for which increment are paid. Differential amount (Arrears) will be shown separately for each element, as represented by process name "Retro pay by element"

6) Run Concurrent Program "Retro Pay by Element"

7) View Element Entries

Global HRMS Manager --> People --> Enter & Maintain --> Assignment --> Entries

As you can see there are 3 entries for Proration Element (Proration formula used) for JAN-10

Proration formula is run for the period JAN-10, See How to use Proration formula

Differentials:

JAN-10 4,193

FEB-10 10,000

MAR-10 10,000

I hope this post is helpful for you.

Kindly provide your feedback.

Leave a comment for any query.

Thanks for your sincere effort.

ReplyDeleteThanks for covering the areas which creates lot of confusion and your step by step explanations and screenshots are very much helpful and easy to understand.

Cheers!

Namrata

There are some loan elements, let say ABC loan deduction (Recurring) was insterted on 01-Jan-2013 against an employee and it has been deducting some amount everymonth. now in Jul-2013 user has stopped or ended ABC LOAN deduction from 31-Jan-2013. now retro is giving reversal of 6 months in Jul-13 period run which I dont need because it is an installment element. how to tackle it ?

ReplyDeleteDear Omer...

ReplyDeleteYou may only include those elements in Element set for which you want to run the retro pay.

Hi,lets assume I got paid 4000 for April and May, but was actually suppose to be paid 4500 for April, May and the rest of the year.

ReplyDeleteI will create a new element and do exactly as you have specified. I only want RetroPay for those two months and that the employee be paid 4500 from June onwards.

do I need to specify the difference somewhere? how will the system know that it should used 4500 for the back pay calculation?

Note: salaries are based on job valid grades.

ebs R12.1

Dear Lou,

DeleteWhat retro pay does is that it re-runs the payroll for previous periods, and differential amounts are created (in individual elements) in current period. Retro is only for previous period adjustments, from June onwards, 4500 will be paid with normal payroll because your salary has increased.

For 500 Rs. difference, kindly attach a miscellaneous or adjustments non-recurring element for the adjustment.

If any further query, kindly ask.

Hi,

ReplyDeleteHow do I tax retro elements during a payroll run?

Hi Luziah,

DeleteDuring a payroll run, if your legislation does not provide tax calculation as seeded functionality, you need to create a balance which will include all those elements which are to taxed using balance feeds window.

if you still have any query, i am happy to help.

Regards,

Waqas

Hi,The extra components are important and will serve to make the transactions easier on our customers. Some of these components include: customer accounts in Incorporation in Qatar so they can make orders via the Internet, an online catalog for online orders, and shipment status to tell the expected time of arrival of their goods. Thanks......

ReplyDeleteHi, Am a real noob.

ReplyDeleteI have an issue setting up the business group info in the Functional Area Maintenance form, there is no LOV values in the business group tab.

Cheers,

Luziah

Hi Luziah,

DeleteI have not come across this issue. Kindly raise an SR if you do not find any solution. I will be thankful if you could share the solution with me.

How does this shows on pay stub, do we run regular payroll run for march and this element shows up on paystub?

ReplyDeleteHi Tap Vias,

DeleteWe run retropay process to take effect of any back dated changes in current period. We run this concurrent process before running the payroll, it creates retro entries in element entries window. Retropay is actually re-running the payroll for previous periods as provided in parameters with updated values. It generates retro entries with differential amounts in current period.

Regards,

Waqas

While creating the location under Work Structure getting the error "APP-FND-00856:Cannot find enabled global segment.Descriptive flexfields require the mandatory Global Context to be enabled.

ReplyDelete"

It is nice to know about retropay. My name is Jimmie and I'm a payroll specialist in Canada. Thank you for providing this blog for the employee like us.

ReplyDeleteRegard

jimmie Menon

payroll services in guelph .

assalamualaikum waqas,

ReplyDeleteThanks for your informative postings,Can you just differentiate between retro pay by element and enhance retro pay

Regards,

Irfan.M.

We offer comprehensive accounting bookkeeping services to companies who wish to outsource their accounting function, Call us at (844) 777-1902.get more detales visit our website: http://accountingdataservice.com/bookkeeping.html

ReplyDelete1844 777 1902 Dial our toll free number today to get support for invoice processing services and get help with 24x7 dedicated technical team.Invoice processing service phone number is to provide you assistance and technical support with Invoice processing. website:- http://accountingdataservice.com/invoiceprocessing.html

ReplyDeleteAccounting Data Service provides best bookkeeping and accounting services.Our online service is safe and secure for any small business accounting bookkeeping firm.Call us at 1-844-777-1902 or visit our website:- http://accountingdataservice.com/bookkeeping.html

ReplyDeleteQuickbooks Online Payroll Service provides best payroll services.Our online payroll service is safe and secure for any small business accounting bookkeeping firm.Call us at 1-844-777-1902 or visit our website:- http://accountingdataservice.com/payroll.html

ReplyDeleteLooking for QuickBooks Customer Service to resolve QuickBooks errors? Call at QuickBooks Support Phone Number +1-844-777-1902 and get support by certified expert or visit our site:-http://accountingdataservice.com/quickbook.html

ReplyDeleteLooking for Quickbooks Customer Service Phone Number? just dial 1-844-777-1902 we will be more then happy to assist you.For more details kindly visit our website-http://accountingdataservice.com/quickbook.html

ReplyDeleteQuickBooks Online Support Phone Number is available to all QuickBooks users and they can use this toll-free telephone number for QuickBooks Online Support.Call us at 1-844-777-1902 or visit our website:-http://accountingdataservice.com/quickbook.html

ReplyDeleteContact QuickBooks Intuit Support Phone Number 1-844-777-1902 for instant help & other QuickBooks payroll services, We’re available 24x7 for any technical assistance or visit our website:-http://accountingdataservice.com/quickbook.html

ReplyDeleteContact QuickBooks payroll Service Number 1-844-777-1902 for instant help & other QuickBooks payroll services, We’re available 24x7 for any technical assistance.Visit our website:-http://accountingdataservice.com/payroll.html

ReplyDelete

ReplyDeleteGet the detailed information of QuickBooks Payroll Support by calling the Toll Free Phone Number 1-844-777-1902 of Technical team of Quickbooks® or visit our website:-http://accountingdataservice.com/payroll.html

Quickbooks technical support phone number 1-844-777-1902 toll free for online accounting software help and support in USA or visit our website:-http://accountingdataservice.com/quickbook.html

ReplyDeletelooking for Quickbooks Technical Support Phone Number? Facing Quickbooks problem? Call now 1-844-777-1902 for certified staff for Quickbooks or visit our website:-http://accountingdataservice.com/quickbook.html

ReplyDeletenice post..

ReplyDeleteSAP BUSINESS ONE for Mines solution

ERP for Mines solution

SAP BUSINESS ONE for Blue metal

ERP for Blue metal

SAP BUSINESS ONE for msand

speedy cash near me I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post.

ReplyDeletePositive site, where did u come up with the information on this posting? I'm pleased I discovered it though, ill be checking back soon to find out what additional posts you include. genf20 plus reviews

ReplyDeleteBookkeeping is one of the best way to set up sales ledger and purchase ledger as it helps to manage finances easily.

ReplyDeleteThat's why most of the accounting firm in these days use bookkeeping services in USA,

and accounting software (Quickbooks online) to manage their sales process easily.

If you're running a business or working in Delhi, you should definitely bookmark Digiliance for everything related to the Minimum Wage in Delhi.

ReplyDeleteAvoid legal risks by following the mandated Minimum Wage in Haryana. Digiliance provides full compliance and payroll support for your business.

ReplyDeleteWondering what the latest P.Tax list of Andhra Pradesh looks like? Visit Digiliance and get all your answers in one place!

ReplyDeleteYou have performed a great job on this article.It’s very precise and highly qualitative. You have even managed to make it readable and easy to read. You have some real writing talent. Thank you so much. quickbooks online payroll core pricing

ReplyDelete